Frederick Colorado Property Records

Frederick property records are maintained by Weld County in this growing community of over 15,000 residents. Located along Interstate 25 in the northern Front Range, Frederick shares a border with Firestone and Dacono. The city has experienced rapid growth as families seek affordable housing near Boulder and Denver. Property records here include assessments, deeds, and tax information. The Weld County Assessor provides online tools for researching this data.

Weld County Assessor for Frederick

The Weld County Assessor values all Frederick properties as part of the county-wide assessment system. This office determines property values for tax purposes each year. Assessment notices show the actual value and assessed value of your land and buildings. Property owners can appeal values they believe are incorrect.

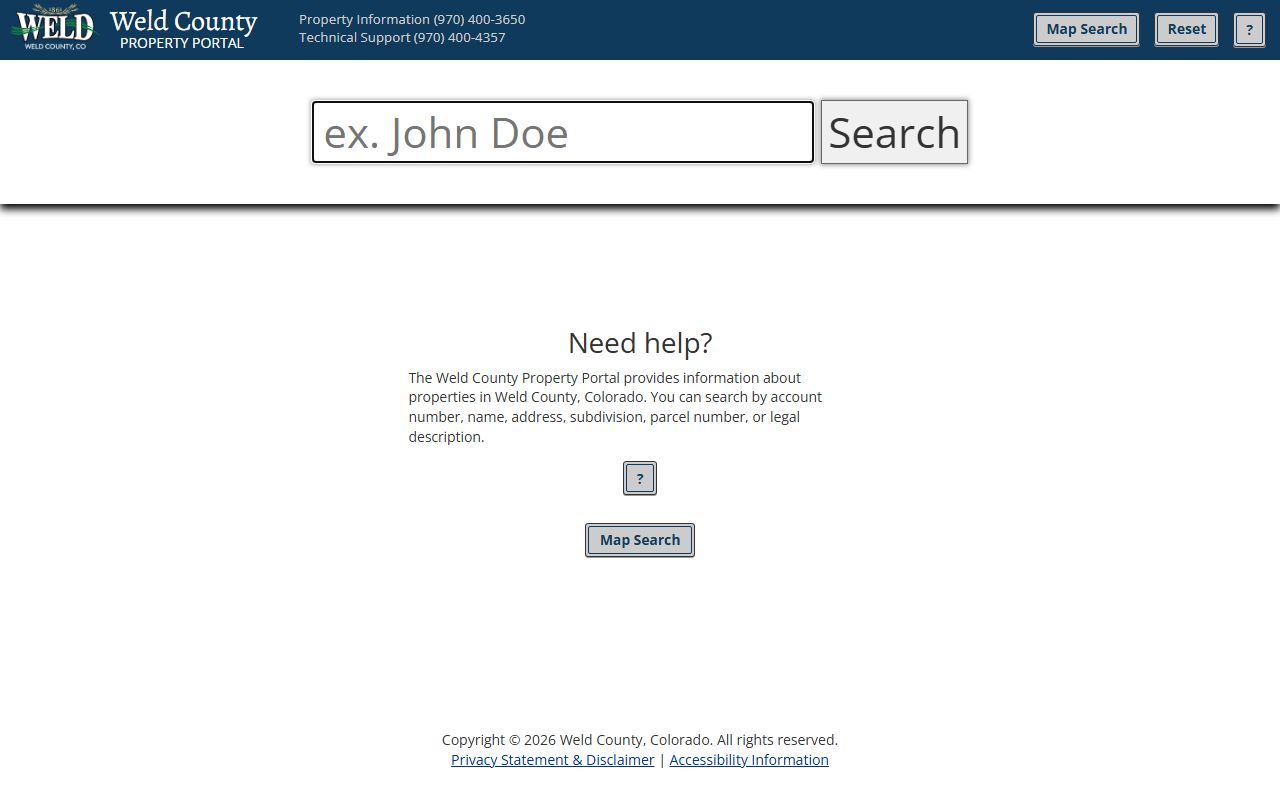

Weld County offers an online property data search for Frederick residents. You can search by address, owner name, or parcel number. The system displays current values, property characteristics, and ownership information. This makes research easy without visiting county offices.

| Office | Weld County Assessor |

|---|---|

| Address | 1400 N. 17th Avenue, Greeley, CO 80631 |

| Phone | (970) 400-3657 |

| Property Search | weld.gov/Property-Data-Search |

How to Search Frederick Property Records

Researching Frederick property records starts with the Weld County online system. The property data search tool lets you find ownership, values, and characteristics. Enter an address or parcel number to get started. Results show assessment details and sales history.

For deeds and recorded documents, use the Weld County Clerk and Recorder services. This office maintains official records of property transfers. You can search online or visit the office in Greeley. Document copies are available for a fee.

Tax records are managed by the Weld County Treasurer. Check your tax payment status and view bills online. The Treasurer's website accepts electronic payments for convenience.

Frederick Real Estate Overview

Frederick has transformed from a small agricultural town to a suburban community. New housing developments offer modern homes for growing families. The location along I-25 provides easy access to employment centers. Property values have increased with the area's popularity.

The Frederick real estate market includes single-family homes, townhomes, and some commercial properties. Many neighborhoods are relatively new, built in the last two decades. The St. Vrain Valley School District serves the area. Parks and trails provide recreation opportunities.

When buying in Frederick, research the property records thoroughly. Check for any metro district taxes that add to your bill. Review homeowner association documents if applicable. Understand the tax implications of your purchase.

Property Taxes in Frederick

Frederick property taxes are based on Weld County assessments. The tax rate includes levies for schools, city services, and special districts. Some newer developments have additional metro district taxes. Review your tax bill carefully to understand all charges.

The Weld County Treasurer collects property taxes for Frederick residents. Tax bills are mailed annually with payment instructions. You can pay online, by mail, or in person. Late payments result in interest and penalties.

Property tax exemptions are available for qualifying seniors and disabled veterans. The Senior Property Tax Exemption can reduce your bill significantly. Contact the Assessor to learn about eligibility and application procedures.

Nearby Communities

Frederick is located near several other communities:

- Firestone (adjacent)

- Dacono (north)

- Mead (north)

- Longmont (west)

- Erie (southwest)

All of these areas are served by Weld County for property records. The county's online search system covers the entire region.

Weld County Property Records

Frederick is part of Weld County's growing northern region. The county provides comprehensive property record services for all residents. For more information about property records in Weld County, visit the county page.