Search Colorado Property Records

Colorado property records provide essential details about land ownership, property values, and real estate transactions across the state. Residents, investors, and researchers rely on these documents to verify ownership and understand local tax assessments. Finding accurate property information helps you make informed decisions about buying, selling, or managing real estate in Colorado. Our guide connects you with county assessor offices, state agencies, and online databases where you can access these vital records quickly and efficiently.

Colorado Property Records Quick Facts

Colorado Property Records Overview

The state of Colorado maintains comprehensive real estate records through multiple agencies and local offices. Each of the 64 counties operates an assessor's office responsible for valuing properties and maintaining ownership records. These offices collect data on residential, commercial, and agricultural land throughout their jurisdictions. Property owners can access assessment rolls, ownership histories, and valuation notices through official channels.

Accessing Colorado property records supports many important activities. Home buyers verify ownership before closing deals. Investors research comparable sales to evaluate purchases. Attorneys confirm clean title transfers during transactions. Each use case depends on accurate information from official sources. Colorado land records form the backbone of property ownership verification throughout the state.

Beyond local assessors, the Colorado Department of Local Affairs oversees property taxation policies statewide. Their Division of Property Taxation provides guidance to county assessors and ensures consistent valuation practices. The department publishes annual reports and reference materials that help taxpayers understand how their properties are valued.

State Resources for Colorado Property Records

Several Colorado state agencies provide valuable tools for accessing real estate information. The Division of Property Taxation website offers links to county assessor offices and explanations of valuation procedures. Their resources help taxpayers navigate the complexities of Colorado's assessment system.

The Colorado Secretary of State manages business entity records that often intersect with property ownership. Limited liability companies, corporations, and partnerships frequently hold real estate titles. Searching business records can reveal the individuals behind these entities when property records list only company names.

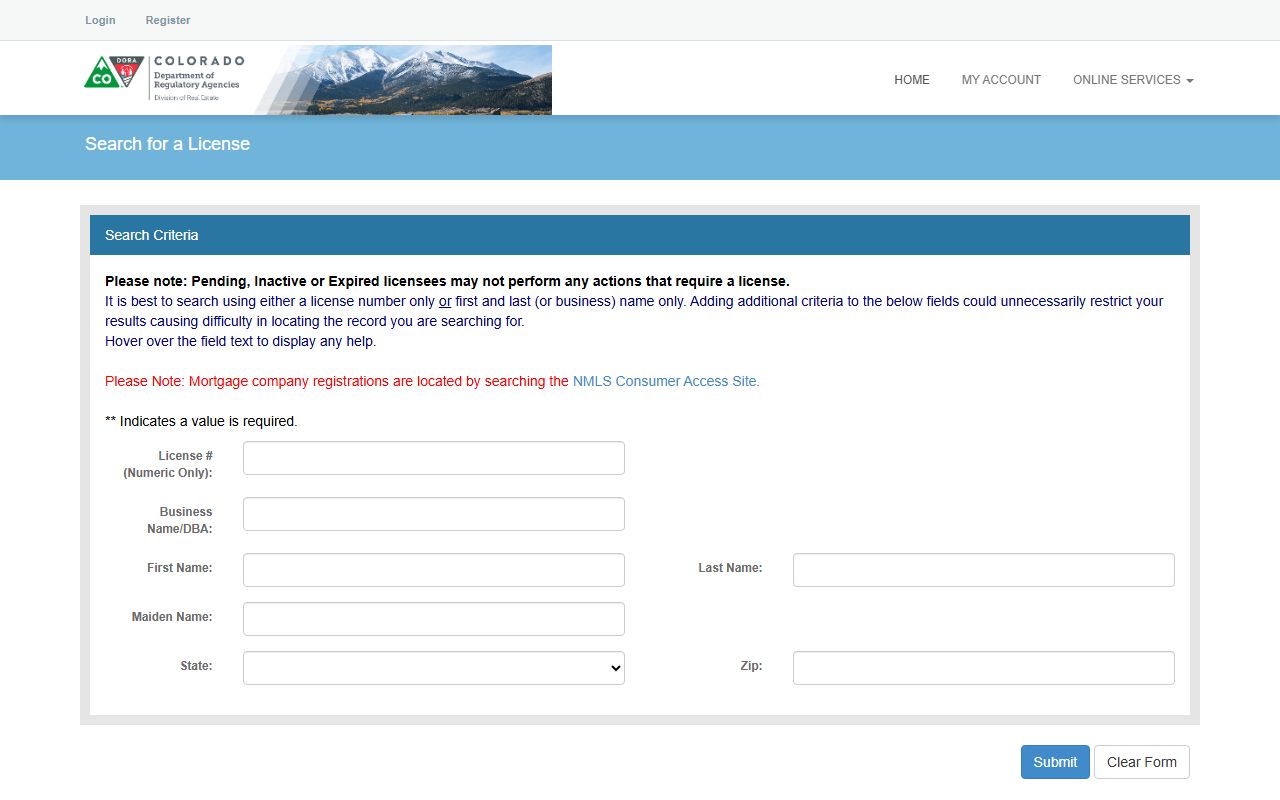

Real estate professionals must maintain active licenses to practice in Colorado. The Division of Real Estate provides an online lookup tool where consumers can verify broker and salesperson credentials. This resource helps property buyers and sellers confirm they are working with properly licensed agents.

Colorado Property Records Access Laws

Colorado law guarantees public access to most government records, including property documents held by county assessors and clerks. The Colorado Open Records Act (CORA) establishes the right to inspect public records during regular business hours. This statute applies to all state and local government bodies, requiring them to produce requested documents promptly.

CORA mandates that agencies respond to record requests within three working days. Complex requests may take longer, but agencies must provide estimates of when records will be available. The law permits agencies to charge reasonable fees for copying documents, though the first hour of research is free. Electronic records are often provided at lower cost than paper copies.

Property tax assessments follow specific statutory frameworks outlined in Colorado Revised Statutes Title 39. This title governs how assessors determine actual value, apply assessment rates, and calculate taxable values. Residential properties currently carry assessment rates between 6.15% and 7.05% of actual value.

Featured Colorado Counties

Each Colorado county maintains its own systems for organizing and providing access to real estate records. Urban counties have invested heavily in online databases that allow instant property searches. Rural counties may rely more on in-person visits to assessor offices. Regardless of location, all counties must comply with CORA and provide public access to their records.

Additional Colorado Property Resources

The Assessors' Reference Library provides standardized resources that help local officials apply consistent valuation techniques. Understanding how assessors calculate values helps property owners interpret their notices and decide whether to appeal assessments they believe are incorrect.

The Colorado Secretary of State website provides access to business entity searches and UCC filings that often relate to property transactions. These records can provide additional context when researching property ownership and financial interests.