Johnstown Colorado Property Records

Johnstown property records span two counties, making this city unique in Colorado. With about 20,600 residents, Johnstown sits at the junction of Weld and Larimer Counties along the Front Range. Property records for the west side of town are maintained by Weld County, while the east side falls under Larimer County jurisdiction. This split requires residents to know which county handles their specific property. Both counties offer online search tools and in-person services.

Johnstown Property Records by County

Johnstown straddles the county line between Weld and Larimer. Properties west of the line belong to Weld County. Properties east of the line belong to Larimer County. This affects where you search records, pay taxes, and vote. Knowing your property's location helps you find the right office.

Both counties maintain separate property record systems. Each has its own assessor, clerk, and treasurer. The values and tax rates may differ between the two sides of town. When buying property in Johnstown, verify which county handles that specific parcel.

| Weld County Assessor | (970) 400-3657 |

|---|---|

| Weld County Search | weld.gov/Property-Data-Search |

| Larimer County Assessor | (970) 498-7050 |

| Larimer County Search | larimer.gov/assessor |

How to Search Johnstown Property Records

Finding Johnstown property records starts with identifying the correct county. Check your address or parcel number to determine if you need Weld or Larimer County. Both counties offer online property search tools that are free to use.

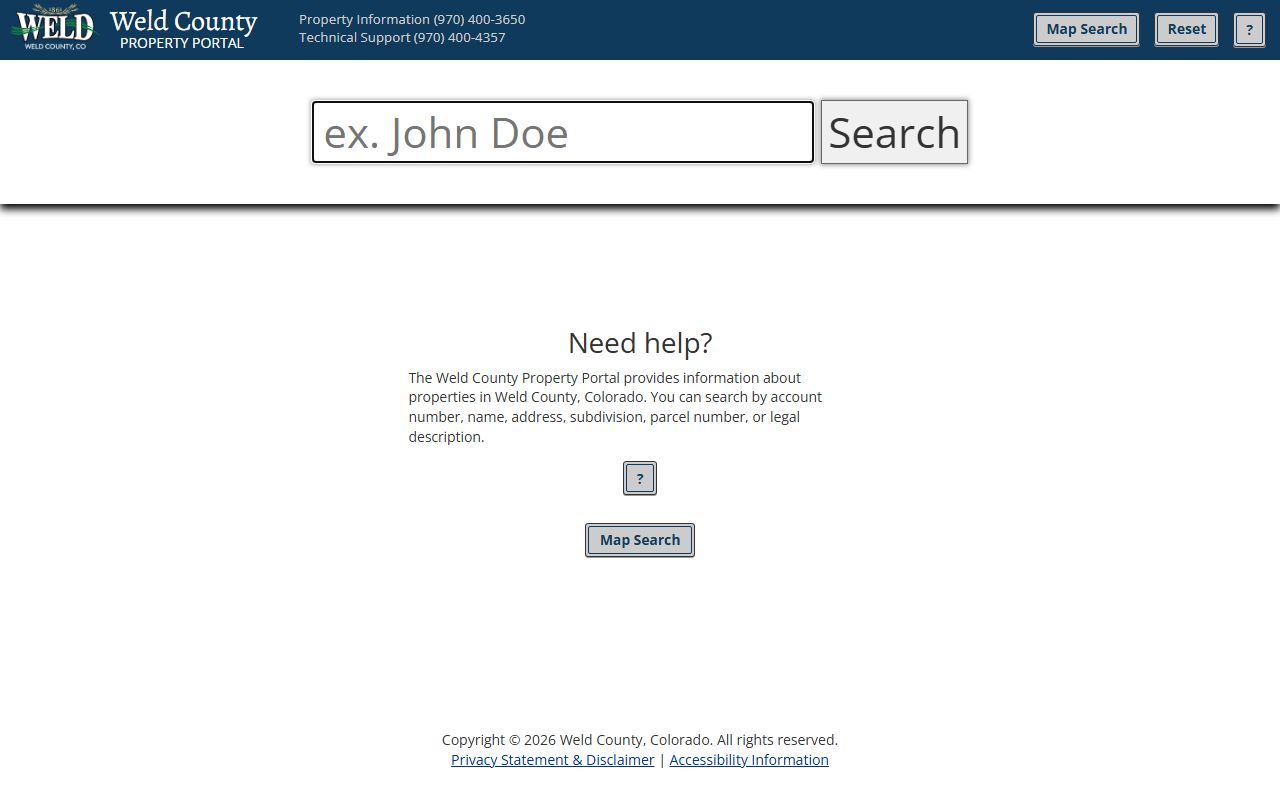

For Weld County properties, use the property data search at weld.gov. You can search by address, owner name, or parcel number. The system shows assessed values, property details, and ownership history. Results download as reports you can save or print.

For Larimer County properties, visit the assessor page at larimer.gov. The online search lets you look up parcels and view assessment information. You can also access GIS maps to see property boundaries.

Johnstown Real Estate Market

Johnstown has grown rapidly as part of the northern Front Range expansion. New home developments attract families seeking affordable housing near larger cities. The location provides access to both Loveland and Greeley for work and shopping. Property values have risen with the population growth.

The city offers various housing types. New subdivisions feature modern single-family homes. Some older areas have established character. Commercial development serves the growing population. The Thompson School District covers most of Johnstown.

When researching Johnstown real estate, compare properties in both counties. Tax rates and services may differ. Check for special districts that add to tax bills. Review development plans that may affect future values.

Property Taxes in Johnstown

Property taxes in Johnstown depend on which county your property is in. Weld County and Larimer County each set their own tax rates and collection schedules. Both counties mail tax bills annually with payment instructions.

Weld County taxes are collected by the Weld County Treasurer. Larimer County taxes go through the Larimer County Treasurer. Each office has its own website for online payments. Payment deadlines are similar but verify with the correct county.

Property tax exemptions are available in both counties. Seniors age 65 and older may qualify for the Senior Property Tax Exemption. Disabled veterans have separate exemption programs. Contact the assessor in your county to apply.

Nearby Communities

Johnstown sits near several other growing communities:

- Loveland (east)

- Milliken (east)

- Berthoud (south)

- Windsor (north)

- Greeley (southeast)

Property records for these areas are split between Weld and Larimer Counties. Windsor and Milliken also straddle the county line. Understanding county boundaries helps you search the right records.

Weld and Larimer County Property Records

Johnstown residents work with both Weld and Larimer Counties for property records. Each county provides online search tools and office services. For more information about property records in these counties, visit their respective pages.