Boulder County Colorado Real Estate Records

Boulder County Property Records provide comprehensive information about land ownership and real estate throughout the north Front Range region of Colorado. The county seat is Boulder, where modern offices maintain extensive records for residential, commercial, and open space properties. The county offers sophisticated online tools including the Boulder County Public Search system. Residents, investors, and researchers can access these records to verify ownership, review assessments, and monitor property changes.

Boulder County Property Records Online Systems

The Boulder County Property Search provides advanced online access to property records. Users can search by address, owner name, account number, or parcel number. Results display current valuations and detailed characteristics. The system includes mapping capabilities. Access is available 24 hours daily.

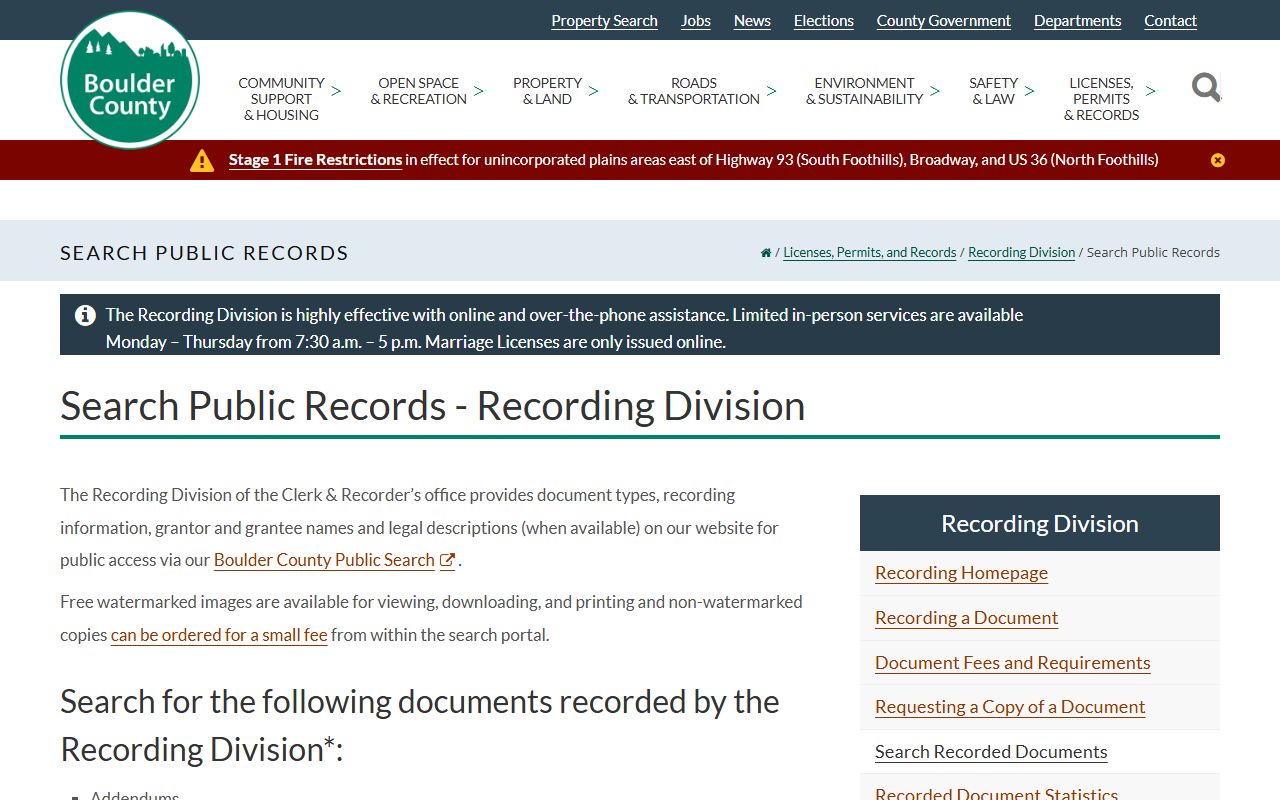

The Boulder County Recording Division offers online access to recorded documents. Deeds, mortgages, and liens are available for search. The system provides free watermarked images. Users can view documents without cost. Certified copies require fees.

Boulder County Public Search extends access to additional records. This platform integrates multiple data sources. Users find comprehensive property information. The interface is designed for ease of use. Both public and professionals benefit.

PropertyAlert service in Boulder County notifies subscribers of changes. Users receive alerts for specified properties. This monitors ownership changes and new recordings. The service helps track interests. Notifications arrive automatically.

The Boulder County Recording Division public records search provides valuable document access.  This system allows users to find recorded documents efficiently. The watermarked images serve research needs. Paid copies provide certified versions for legal use.

This system allows users to find recorded documents efficiently. The watermarked images serve research needs. Paid copies provide certified versions for legal use.

Boulder County Assessment Records

Assessment records form a major component of Boulder County property records. The Assessor values all taxable property annually. These values determine tax obligations. Notices mail to owners each spring. Appeals follow established procedures.

Boulder County uses sophisticated valuation methods. Residential properties carry assessment rates set by the state legislature. Current rates range between 6.15% and 7.05% of actual value. Commercial properties have higher rates. Open space lands have special classifications.

The assessment appeal process in Boulder County protects property owners. Notices explain appeal rights and deadlines. Appeals start with the Assessor's Office. The County Board of Equalization hears unresolved disputes. Further appeals reach the Board of Assessment Appeals or courts.

Property characteristics in Boulder County assessment records include extensive detail. Land size, zoning, and use are documented. Building square footage, features, and quality are recorded. Sales histories show recent transactions. All factors contribute to valuations.

The Colorado Division of Property Taxation provides oversight for Boulder County assessments. State standards ensure uniformity. Resources include guidance documents and statistical reports. Appeals may be filed with state boards.

Boulder County Recording Division and Deed Records

The Boulder County Recording Division maintains deed records and other documents. Located at 1750 33rd Street, Suite 201 in Boulder, this office serves the public daily. Recording creates official notice of property interests. Indices allow searching by multiple criteria.

Recorded documents in Boulder County include various types. Deeds transfer ownership interests. Mortgages and deeds of trust secure loans. Liens claim unpaid debts. Easements grant use rights. Releases clear satisfied obligations. Each document type serves specific legal purposes.

Searching Boulder County deed records uses modern technology. Online systems provide instant access. Users search by name, date, or document type. Images display on screen. Downloads are available for many records. This accessibility supports efficient research.

Title research in Boulder County often spans many decades. Ownership chains must be complete and unbroken. Liens and encumbrances must be identified. Easements affect property use rights. Professional title searchers understand these complexities. Their expertise ensures thorough examination.

Boulder County Communities and Municipal Records

Boulder County property records serve multiple cities and towns. Boulder is the county seat and largest city. Longmont provides a major population center. Louisville and Lafayette are established communities. Superior, Nederland, and Lyons are smaller municipalities. Unincorporated areas complete the county.

The following communities rely on Boulder County real estate records:

- Boulder - County seat and home to University of Colorado

- Longmont - Second largest city in the county

- Louisville - Historic coal mining town turned residential

- Lafayette - Diverse community with mixed land uses

- Superior - Residential community with commercial areas

- Lyons - Mountain town at the county's western edge

- Nederland - Mountain community in the foothills

Each community generates property records within Boulder County. Municipal boundaries create layered systems. Cities maintain planning and zoning records. The county handles assessments and deeds. Comprehensive research uses both levels.

Open space preservation affects Boulder County property records. The county has extensive protected lands. Conservation easements appear in records. Public ownership is documented. These programs create unique property patterns.

Boulder County Property Market and Records Activity

The Boulder County real estate market generates substantial records activity. High property values create significant assessments. Active transactions produce numerous deed recordings. New construction adds to the rolls. Market changes affect valuations.

Residential properties dominate Boulder County records. Single-family homes are most common. Condominiums and townhomes add density. Multi-family properties provide rental housing. Each type has distinct assessment characteristics.

Commercial real estate in Boulder County includes diverse properties. Office buildings serve businesses. Retail centers provide shopping. Industrial properties support manufacturing. Research facilities are prominent. Records document all these uses.

The University of Colorado Boulder affects local property records. Student housing creates demand. University properties have special status. Surrounding areas have distinctive markets. These factors appear in assessment data.

Legal Framework for Boulder County Property Records

Colorado law ensures public access to Boulder County property records. The Colorado Open Records Act mandates inspection rights. C.R.S. § 24-72-203 specifies access procedures. County offices comply comprehensively.

Boulder County exceeds minimum access requirements. Multiple online systems serve users. Records are available beyond business hours. Technology extends accessibility. These practices support public needs.

Colorado Revised Statutes Title 39 governs property assessment procedures. This framework applies to Boulder County valuations. Assessment rates derive from legislation. Appeal rights protect property owners. Understanding these laws helps navigate the system.

The Colorado Division of Property Taxation provides state oversight. This ensures uniform practices across counties. Resources include guidance documents. Appeals may reach state boards.

Boulder County Property Research Best Practices

Successful research in Boulder County property records leverages available technology. Online systems provide instant access. Define objectives clearly. Use appropriate search methods. Verify findings through multiple sources.

Start with the Boulder County Property Search for basic information. Enter addresses or parcel numbers. Review assessment data and characteristics. Save relevant findings. This establishes a research foundation.

Use the Recording Division search for ownership verification. Look for recent deeds. Check for liens and encumbrances. Review historical documents as needed. The watermarked images serve research purposes.

Consider the Public Search system for comprehensive results. This integrates multiple data sources. Results may include additional context. Cross-reference findings with other systems. This improves accuracy.

Document all research carefully. Note which systems were used. Record dates of searches. Save copies of important documents. Good documentation supports future reference and legal needs.

For complex research, professional assistance is available. Title companies conduct ownership searches. Real estate attorneys interpret documents. These services provide expertise for difficult projects.