Eagle County Property Records

Eagle County property records are accessible through the Acclaim public records search system. The county seat is Eagle, located in the heart of Colorado's mountain resort region. Eagle County includes Vail, Beaver Creek, and other world-class destinations. The Assessor maintains records for luxury homes, commercial properties, and mountain land. The Acclaim system provides comprehensive access to recorded documents and property information.

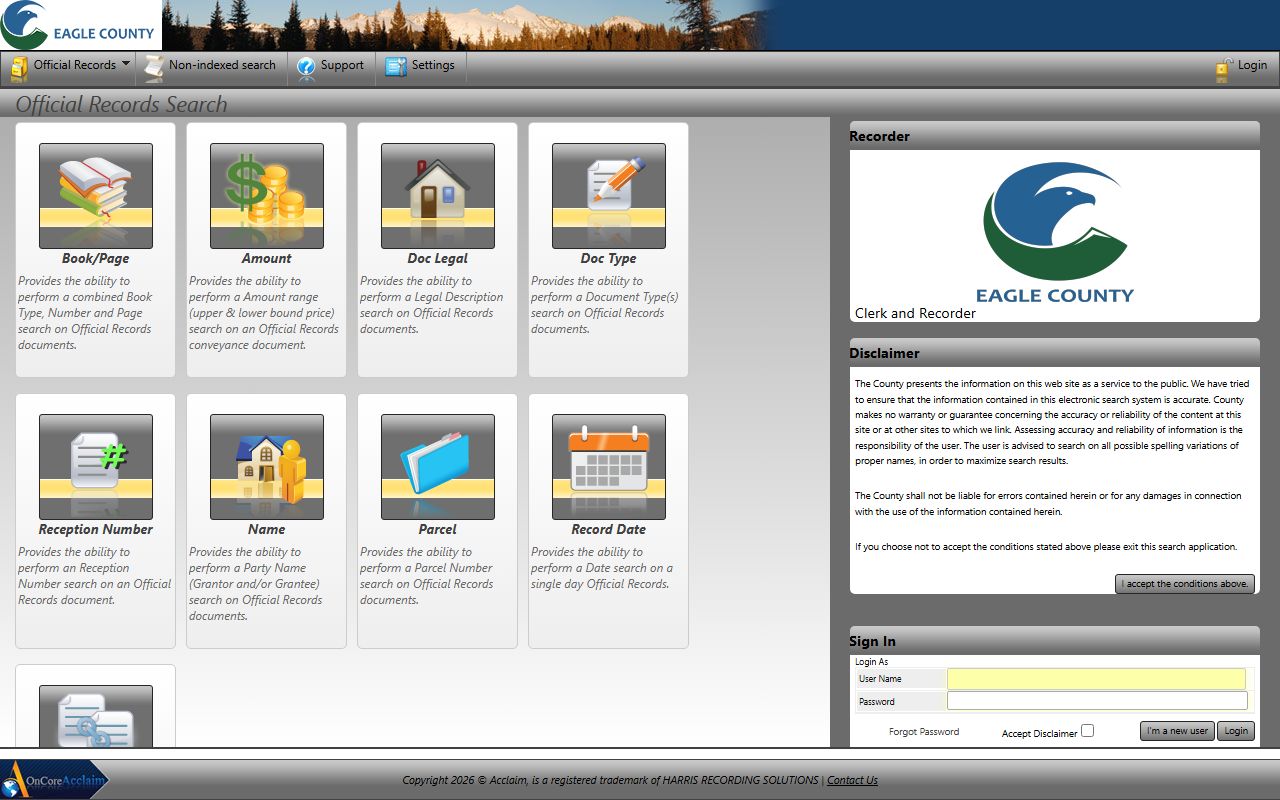

Eagle County Acclaim Public Records Search

Eagle County uses the Acclaim system for public records access. This comprehensive platform combines Assessor and Clerk and Recorder records. You can search recorded documents by multiple criteria. The system includes deeds, mortgages, liens, and other instruments. Eagle County property records are fully searchable through this integrated platform.

The Acclaim system allows searches by book and page, legal description, document type, grantor or grantee, and parcel number. This flexibility helps researchers locate specific documents efficiently. Document images are available for viewing and printing. The system covers historical records as well as current filings.

| System | Eagle County Acclaim Public Records |

|---|---|

| Website | acclaim.eaglecounty.us |

| Search By | Book/Page, Legal Description, Document Type, Grantor/Grantee, Parcel |

| Records Include | Deeds, Mortgages, Liens, Assessor Data, Plats |

Eagle County Assessor

The Eagle County Assessor values all taxable property in the county. This includes residential properties in Vail, Avon, and Edwards. Commercial properties include hotels, restaurants, and retail establishments. The Assessor also values vacant land and conservation easements. Property values reflect the unique mountain resort market conditions.

You can access Eagle County assessment records through the Assessor's website. The site provides property search tools and valuation information. Assessment notices are mailed to property owners each year. These notices include the actual value and assessed value. Property owners may appeal assessments they believe are incorrect.

The Eagle County Assessor's office is located in Eagle. Staff can assist with property research and valuation questions. The office coordinates with the Acclaim system for integrated record access. Contact the Assessor for detailed property information.

Eagle County Property Types

Eagle County contains diverse property types reflecting its mountain resort economy. Luxury residential properties dominate the Vail and Beaver Creek areas. These homes often command premium valuations. The Assessor uses specialized methods for high-value mountain properties. Sales of comparable properties inform valuation decisions.

Commercial properties in Eagle County include world-class resorts and amenities. Hotels, ski facilities, and retail centers generate significant property tax revenue. The Assessor values these properties based on income potential and market data. Commercial assessments require specialized appraisal expertise.

Agricultural properties and open space remain important in Eagle County. Conservation easements protect scenic and ecological values. These properties may qualify for reduced assessment rates. The Assessor works with landowners to properly classify these properties. Eagle County property records document these various land uses and classifications.

Eagle County Property Tax Records

Property taxes in Eagle County support local services and school districts. The County Treasurer collects taxes based on Assessor valuations. High property values in Eagle County generate substantial tax revenue. Tax rates vary by location and taxing district. Property owners receive annual tax bills detailing obligations.

You can search Eagle County property tax records through county systems. The Treasurer provides payment status and balance information. Property taxes can be paid online, by mail, or in person. Delinquent taxes accrue interest and penalties. Tax lien sales may occur for seriously delinquent accounts.

Eagle County offers property tax exemptions for qualifying owners. Senior citizens may receive tax relief through state programs. Disabled veterans qualify for additional exemptions. Applications must be submitted to the Assessor's office. These programs reduce tax burdens for eligible property owners.

How to Search Eagle County Property Records

Searching Eagle County property records starts with the Acclaim system. This unified platform provides access to both recorded documents and assessment data. Researchers can search by multiple criteria to locate specific records.

To search Eagle County property records:

- Visit the Acclaim website at acclaim.eaglecounty.us

- Select your preferred search method from the available options

- Enter search criteria such as name, parcel number, or legal description

- Review search results and select relevant documents

- View or print document images as needed

The Acclaim system requires user registration for full access. Subscription options are available for frequent users. Pay-per-document options suit occasional researchers. Eagle County property records are public information under Colorado law.

Nearby Counties

These counties border Eagle County and maintain separate property records systems. Mountain properties near county lines may require checking multiple jurisdictions.