Property Records Search in Morgan County

Morgan County Property Records provide essential information about land ownership, property values, and real estate transactions throughout northeastern Colorado. Residents, investors, and researchers rely on these documents to verify ownership, research market trends, and understand local tax assessments. The county seat is Fort Morgan, where the Assessor and Clerk offices maintain comprehensive records. Finding accurate property information helps you make informed decisions about buying, selling, or managing real estate in Morgan County.

Morgan County Property Records Overview

Morgan County maintains extensive property records for public access. The Assessor's Office values all real estate within county boundaries. The Clerk and Recorder handles deed records and document recording. These offices work together to serve residents. Property records in Morgan County cover residential, commercial, and agricultural land. The county spans productive agricultural areas on Colorado's eastern plains.

The Morgan County Assessor's Office provides property records access through their office at 231 Ensign St., Fort Morgan, CO 80701. This office allows property owners and researchers to search for parcel information, view assessment data, and access ownership records. The county maintains comprehensive land records to support property transactions and tax administration.

Morgan County property records serve diverse needs throughout the community. Home buyers verify ownership before completing purchases. Sellers confirm their title status before listing properties. Investors research comparable sales to evaluate opportunities. Attorneys review deed records for title verification. Lenders examine property documents before approving mortgages. Taxpayers check assessment records to understand valuations. Each use depends on accurate, current information from official sources.

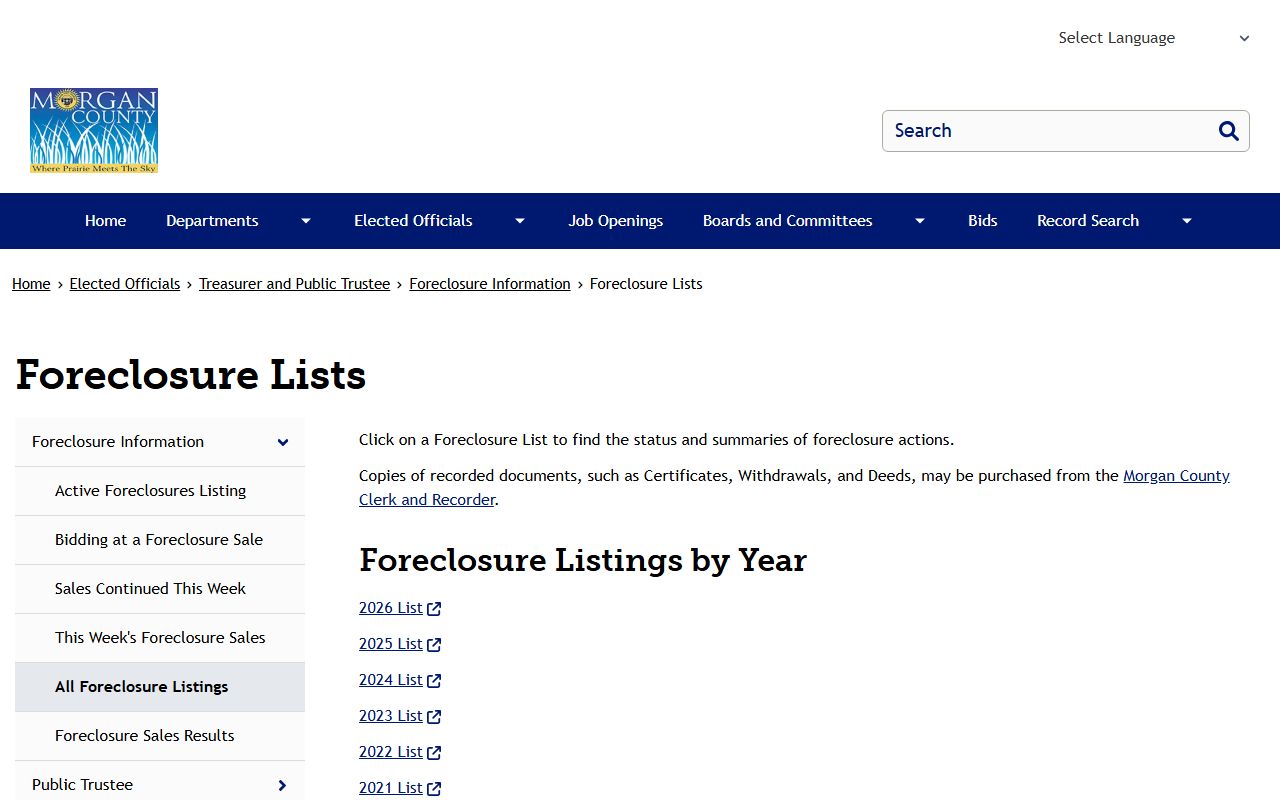

The Morgan County foreclosure lists provide information about properties in foreclosure proceedings.  These lists help identify potential investment opportunities and provide transparency about distressed properties. The county maintains current foreclosure information for public access.

These lists help identify potential investment opportunities and provide transparency about distressed properties. The county maintains current foreclosure information for public access.

Morgan County Real Estate Records Access

Accessing Morgan County land records requires understanding the available channels. The Assessor's Office provides valuation and ownership information at (970) 542-3512. The Clerk and Recorder maintains recorded documents including deeds and liens at (970) 542-3521. Both offices are located at 231 Ensign St., Fort Morgan, CO 80701. Online resources offer convenient remote access.

The Morgan County Clerk and Recorder handles all document recording for real estate transactions. This office records deeds, mortgages, liens, and other instruments affecting property title. Recording creates public notice of interests in land. The office maintains indices by grantor, grantee, and document type. Researchers can search these records to trace ownership history. Certified copies are available for legal purposes.

Morgan County property records include various document types essential for ownership verification. Deed records show transfers between parties. Mortgage records indicate liens against properties. Tax records reflect assessment and payment status. Plat maps define subdivisions and lot boundaries. Survey records establish precise property lines. Together these documents create a comprehensive picture of property status.

Parcel numbers provide the most reliable method for searching Morgan County property records. Each parcel receives a unique identifier that remains constant over time. These numbers appear on assessment notices, tax bills, and recorded documents. Using parcel numbers avoids confusion from address changes or similar street names.

Morgan County Assessment Records

Assessment records form a core component of Morgan County property records. The Assessor values all taxable property annually. These values determine property tax obligations. Assessment notices mail to owners each year. Owners may appeal valuations they believe incorrect. The Assessor's Office can be reached at (970) 542-3512 for questions.

The assessment process in Morgan County follows Colorado statutory requirements. Assessors consider recent sales, property characteristics, and market conditions. Residential properties carry assessment rates established by state law. Commercial properties face higher assessment rates. The Assessor maintains detailed files on each parcel.

Morgan County property owners receive assessment notices each year. These notices state the property's actual value, assessment rate, and estimated taxes. Owners who disagree with valuations may file appeals. The appeal process begins with the county assessor. Understanding assessment records helps owners participate effectively.

Searching Morgan County Land Records

Effective searches of Morgan County property records require preparation and strategy. Gather basic information before beginning research. Collect addresses, owner names, and parcel numbers if available. Define your research goals clearly.

In-person research at Morgan County offices allows examination of complete record sets. Staff can assist with difficult searches. Physical records may include documents not yet digitized. Researchers can view historical records. This approach benefits complex title searches. County offices are located in Fort Morgan.

Cross-referencing multiple sources improves accuracy when researching Morgan County property records. Compare assessor records with recorded documents. Verify current ownership through recent deeds. Each source provides different perspectives.

Morgan County Property Records for Communities

Morgan County land records serve several incorporated communities. The city of Fort Morgan serves as the county seat with full records access. Other communities within the county include Brush and Wiggins. Property records for these areas are maintained by Morgan County.

Research in municipal areas may require checking both city and county records. Building permits appear in city files. Property valuations come from the county assessor. Zoning information resides with city planning departments. Morgan County property records provide the foundation for ownership and valuation data.

Each community contributes to the diversity of Morgan County property records. Residential neighborhoods, commercial districts, and agricultural areas all generate records. The variety of property types creates a rich archive of land records.

Morgan County Deed Records and Document Types

Deed records constitute essential documents in Morgan County property records. These instruments transfer ownership interests between parties. Various deed types serve different purposes. Warranty deeds provide strongest guarantees. Quitclaim deeds transfer whatever interest exists.

Beyond deeds, Morgan County land records include numerous other document types. Mortgages secure loans with property collateral. Deeds of trust serve similar functions. Liens claim interests for unpaid debts. Easements grant use rights across properties. Restrictions limit property uses.

Understanding document types helps researchers interpret Morgan County real estate records accurately. Recording dates establish priority between competing claims. Legal descriptions precisely identify affected parcels. Reviewing complete documents reveals full legal effects.

Legal Framework for Morgan County Property Records

Colorado law governs Morgan County property records systems. The Colorado Open Records Act ensures public access. Statutes mandate maintenance standards. Regulations specify retention periods. These legal provisions protect public interests.

Assessment procedures follow Colorado Revised Statutes Title 39. This title governs valuation methodology. Assessment rates are set by legislation. Appeal rights protect owners. The statutory framework balances revenue needs with taxpayer protections.

Recording practices comply with Colorado Revised Statutes Title 38. This title governs real estate transactions. Recording requirements create public notice. Priority rules determine lien ordering. These rules protect property rights.

Morgan County Property Research Tips

Successful research in Morgan County property records begins with clear objectives. Know what information you need. Understand how you will use it. Choose appropriate sources. Verify critical findings.

Begin searches with complete identifying information. Parcel numbers work best. Current addresses help. Owner names assist. Legal descriptions precisely identify properties.

Visit county offices for complex research. Staff expertise helps difficult searches. Physical records may contain details not in digital systems. Plan visits during business hours.

Stay current with Morgan County property records changes. Systems upgrade periodically. Check websites regularly. Ongoing awareness improves research effectiveness.