Broomfield County Property Records

Broomfield County property records are maintained by the Assessor's Office in this consolidated city and county. As Colorado's newest county, formed in 2001, Broomfield maintains modern property record systems. Residents can access real estate documents, assessment information, and ownership data through the county's online portals and in-person services. The county provides comprehensive access to property information including assessment rolls, deed records, and foreclosure data. Property owners and researchers can utilize these resources to verify ownership, understand valuations, and research property history.

Broomfield County Quick Facts

Broomfield County Assessor's Office

The Broomfield County Assessor's Office values all property within the county for tax purposes. This office maintains records on approximately 25,000 residential and commercial parcels. Property owners receive annual valuation notices showing their property's assessed value. The assessor uses mass appraisal techniques and market data to determine fair values.

Broomfield operates as a consolidated city and county, meaning one government serves both municipal and county functions. This structure streamlines property record access for residents. The Assessor's Office works closely with other departments to maintain accurate ownership records and property characteristics. Staff are available to answer questions about valuations and appeal procedures.

| Office | Broomfield County Assessor |

|---|---|

| Address | One DesCombes Drive, Broomfield, CO 80020 |

| Phone | (720) 887-2130 |

| Website | broomfield.org/assessor |

| Hours | Monday through Friday, 8:00 AM to 5:00 PM |

Public Trustee Foreclosure Search

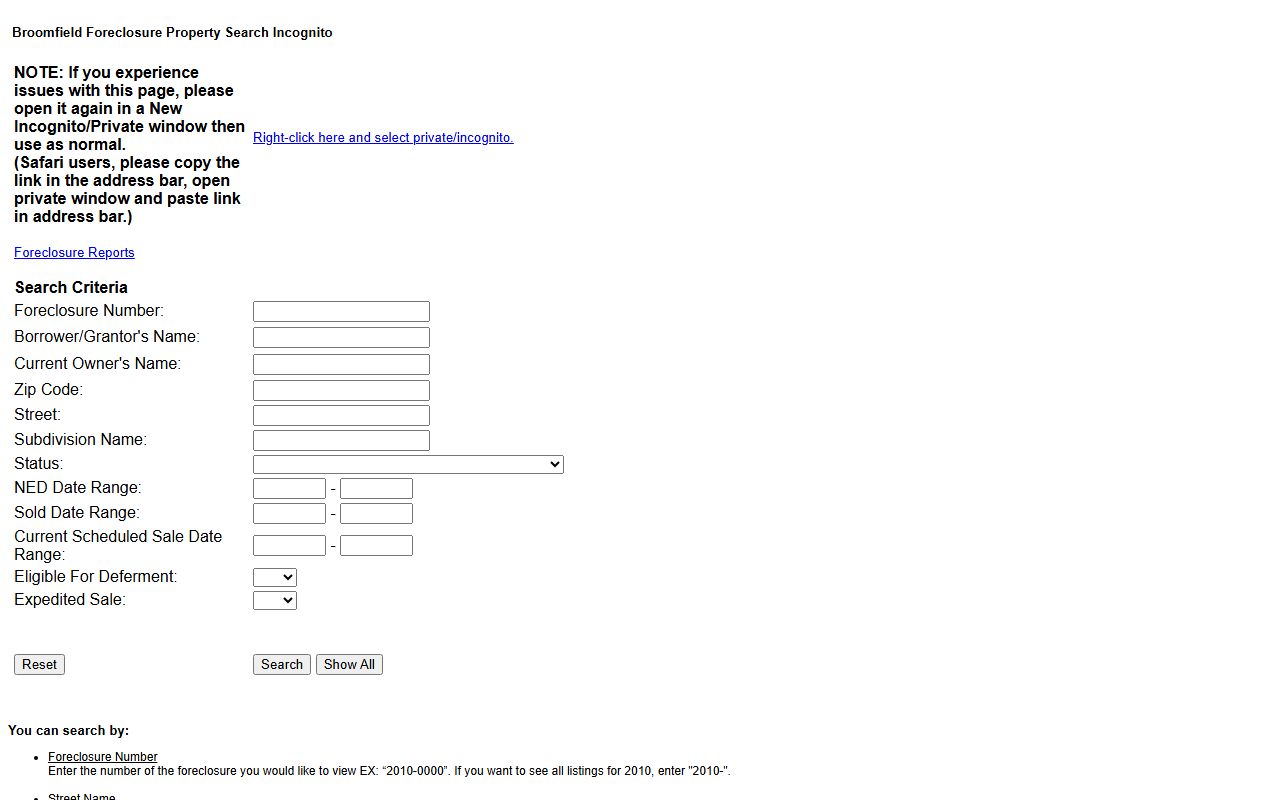

Broomfield County maintains a Public Trustee foreclosure search system for researching foreclosure proceedings. This online database allows users to search active foreclosure cases and view case details. The Public Trustee's Office processes all foreclosure filings in Broomfield County according to Colorado law.

The foreclosure search system provides information about properties in various stages of the foreclosure process. Users can search by property address, owner name, or foreclosure date range. This resource helps homeowners, investors, and researchers track foreclosure activity in Broomfield County. The database is updated regularly to reflect new filings and case developments.

To access the Broomfield County foreclosure search, visit the Public Trustee's online portal. The system requires no registration for basic searches. For detailed case information or certified documents, contact the Public Trustee's Office directly. The online search provides a convenient starting point for foreclosure research in Broomfield County.

Access the foreclosure search at foreclosure.broomfield.org. This tool is part of Broomfield County's commitment to transparent property records access. The Public Trustee's Office can provide additional assistance with foreclosure-related questions.

Accessing Broomfield Property Records

Broomfield County provides multiple methods for accessing property records. The Assessor's website offers online property search tools where users can look up parcels by address or parcel number. These searches return assessment data, property characteristics, and ownership information. Online access is available 24 hours a day.

For documents requiring in-person review, visit the Assessor's Office during business hours. Staff can assist with complex searches and provide copies of property records. The office maintains maps, aerial photos, and detailed property sketches. All property records are public information under Colorado law.

The Clerk and Recorder's Office maintains official deed records and other recorded documents. This office is located at the same address as the Assessor. Property transfers, mortgages, and liens are recorded with the Clerk and Recorder. These records establish legal ownership and encumbrances on Broomfield County properties.

Property Assessment Appeals

Property owners who disagree with their assessed values may file appeals with Broomfield County. The appeal process begins with an informal meeting with the Assessor's Office. If not resolved informally, formal appeals proceed to the County Board of Equalization. Appeals must be filed within specific timeframes after valuation notices are mailed.

The assessment appeal process allows property owners to present evidence supporting their opinion of value. Comparable sales data, property condition issues, and other relevant factors may be considered. The Assessor's Office provides appeal forms and instructions on their website. Understanding the appeal process helps property owners exercise their rights effectively.

Broomfield County conducts reappraisals every odd-numbered year as required by state law. During reappraisal years, all property values are updated to reflect current market conditions. Property owners should review their notices carefully and understand their appeal rights. The Assessor's Office offers resources to help taxpayers understand the valuation process.

Nearby Counties

These counties border Broomfield County. Property records for these jurisdictions are maintained by their respective county assessor offices.